By RON LIEBER

Published: January 25, 2013 in The NY Times

If you have ever disputed a charge with your debit or credit card company, you know what a potent weapon this type of complaint can be.

The card issuer generally takes your word against the merchant or service provider at the outset, restores the money to your bank account temporarily or issues a credit and then goes about its investigation. It essentially demands that the merchant or service provider who supposedly did you wrong prove that it did no wrong at all.

But if you have never wielded this power tool of consumerism, there are a few things you should know first. The cat and mouse game that goes on behind the scenes can be tilted much more — or much less — in your favor, depending on which charges you dispute and how you go about disputing them.

Chances are you will need to use the dispute process sooner or later. We live in a world where you often cannot use cash to buy cocktails on an airplane and any individual can attach a card reader to a smartphone and accept card payments from anyone else. Mistakes will inevitably be made.

Meanwhile, all sorts of online businesses depend on recurring subscription revenue. Mistakes will inevitably be made again. Oops, we somehow forgot to honor your request to cancel your subscription. Oops, we forgot again. Oh, but now it will take until the next billing cycle. Sorry!

You have had the legal right to correct these mistakes ever since 1975, when the Fair Credit Billing Act went into effect. The law dictates that there be a process by which you can question unauthorized charges, billing errors and transactions involving goods or services you never received or merchants did not deliver in the way they were supposed to.

This creates problems for merchants. Plenty of people pretend that they never received products that were supposed to arrive by mail and then dispute the charge, hoping their card company won’t be able to figure out that they are liars and thieves.

Even legitimate beefs or misunderstandings create many problems. In the 12 months ending Sept. 30, 2012, Visa processed $2.07 trillion in transactions in the United States. While cardholders disputed just 0.037 percent of that amount, that adds up to $765.9 million in transactions under review. According to MasterCard, 0.05 percent of its transactions worldwide are subjects of dispute, so its card issuers will probably deal with over 15 million questionable charges this year. Several million of these disputes involve outright fraud, though none of the card networks would break out the exact percentages. Avivah Litan, an analyst at Gartner, estimates that 20 percent of disputes involve fraud.

The rest require a lot of manual labor. Every time someone initiates a dispute, the bank that issued the card must look into it. Someone has to contact the merchant and wait for a reply that may include a receipt or other documentation.

Merchants must carve out time to respond to each dispute. They also pay one-time fees for the privilege and may end up paying higher overall fees to accept cards if disputes are too frequent. Or they just get cut off from accepting cards altogether.

The true cost per dispute to the banks of all of this back and forth ranges from $10 to $40, according to a 2010 estimate by the consultants at First Annapolis. Given that cost, according to Scott Reaser, a principal there, many banks will simply absorb the disputed charge on a consumer’s bill and never contact the merchant if it is below a certain threshold.

That number will differ for every bank, though it probably averages around $25. Some large retailers, it turns out, have similar strategies, according to a 2009 Government Accountability Office report. So even if the bank contacts a merchant about the dispute, the merchant may allow the customer to win the dispute without bothering to investigate the complaint. The report did not say what the threshold was, and the G.A.O. is not permitted to identify the retailers it spoke to.

It is tempting to conclude that you can get away with disputing any old thing under $25 and not have to worry about tangling with the merchant again. But given that frequent disputes can lead to higher costs down the road, some merchants vow to fight every one.

Or they have consultants who make them fight as a condition of offering their assistance. That’s how Monica Eaton-Cardone, the co-founder of Chargebacks911.com, works with her merchant clients to help them keep their dispute rates down and get out (or stay out) of trouble with the companies that control their ability to accept cards.

Why does she operate that way? The answer begins with her own painful experience in the direct response business, selling things to people who sometimes didn’t like what they received in the mail or didn’t realize they had signed up for a recurring service with regular bills.

Faced with the threat of losing her ability to accept cards if the number of disputes didn’t decline, she realized there was a very basic problem with the process: she concluded that over 70 percent of the people disputing charges with their bank never called her, the merchant, to complain first.

“When you go to a bank’s Web site and you see a button that says, ‘Dispute This Transaction,’ it doesn’t say that this is going to hurt the merchant and could actually increase the costs of buying a service from this business,” she said. “It just tells you that there’s a quick and easy way to cancel your subscription right here. And you can get a refund! If you don’t want to pay your whole bill, just click on this button.”

She is not blaming consumers. They are just doing what their banks prompt them to do. “But not fighting back is sending the wrong message to consumers and card companies,” she said. “Letting the dispute go tells them that this is a sure way to get a no-questions-asked refund.”

It is unclear how effective this campaign has been, and you could be forgiven for thinking that the dispute process is something of a free-for-all. After all, some service providers resort to outright intimidation to keep their dispute numbers low.

The proprietors at Enchanted Attire, an online clothing retailer, wish to inform you that “you agree not to file a credit card or debit card chargeback with regard to any purchase” and that “in the event that a chargeback is placed or threatened on a purchase, we also reserve the right to report the incident for inclusion in chargeback abuser database(s) of our choosing.” Oh, and by the way, “being listed on such databases may make it more difficult or even impossible for you to use (any of) your credit card(s) on future purchases with us or other merchants.”

Movers have been known to do this, too.This violates Visa’s and MasterCard’s rules, for starters, and none of the experts I spoke with this week knew of anyone keeping a database for this purpose that merchants could contribute to and that other merchants could gain access to. No one from Enchanted Attire returned my messages to shed light on this.

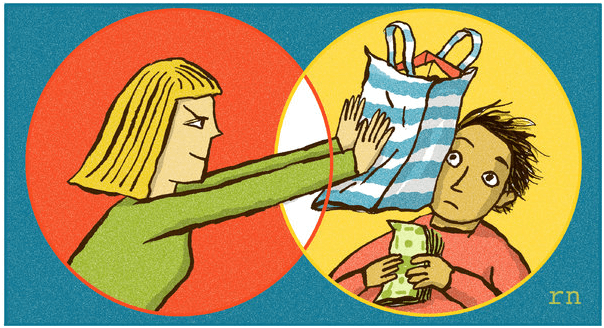

It shouldn’t take threats to keep us in line, though. Jim Van Dyke, chief executive of Javelin Strategy and Research, suggests a simple framework for people who want to wield the dispute weapon and bask in its power but not be totally obnoxious about it.

“The consumer owes the merchant one tangible shot, one wholehearted best effort to make things right,” he said. “But if they breach their commitment, then the consumer should simply escalate it and say goodbye to that merchant.”